Quietly, without fanfare - and with the vast bulk of citizens unaware - the world bankers have been building an international money machine: an international Federal Reserve System with power to control the world's financial and economic system.

--

So here we have it. The Federal Reserve is a private monopoly of money credit created by Congress under highly questionable circumstances which is beholden to the Chairman of the Board and whose decisions cannot be changed by Government or anyone else.

Anthony Sutton

The Federal Reserve.

What a great name. They really have a way with words.

Could anything sound more Government-like?

I’m of the view that there is no way to understand modern Empire, our Empire, without understanding Fiat Central Banking.

The power to create national money (national debt) out of nothing.

While having that nation pay real cash interest (taxes etc.) on the issued fiction.

In essence Nation States are now mostly Administered Territories, with a Uniparty facade of democratic choice, whose primary function is to tax their populations so that they can meet their ever-increasing international debt and other obligations.

To begin to understand this I recommend reading the work of Joe Plummer (interviewed), Dishonest Money.

I also recommend reading 180 Degrees by Feargus Greenwood (interviewed) that has a great section on Central Banking.

The shape of my thoughts on the subject, so far, goes something like this:

Without Expanding Capital there is no Empire.

Empire’s Roaming Capital demands Freedom and Protection.

A Primary Purpose of Empire is to protect Capital while eliminating all Friction on its movement.

To do this, they must Control Nations, the primary source of Friction and Threat to Empire’s Capital.

Empire’s highest purpose is Control. Of Nations and All within them.

The most effective means of Control is Debt.

If you can Create Debt, you can Create Control.

If you can Create Debt out of Nothing, you can create Control out of Nothing.

Creating Control out of Nothing is the mightiest human power.

Whoever has the right to Create Debt and Control out of nothing, Controls the World.

In The Swarm I said:

What I think is missing in his presentation in terms of language and concepts are:

The concept of Empire is missing.

The language of Cartels is missing.

There is no mention of Oligarchy.

There is no mention of Central Banking.

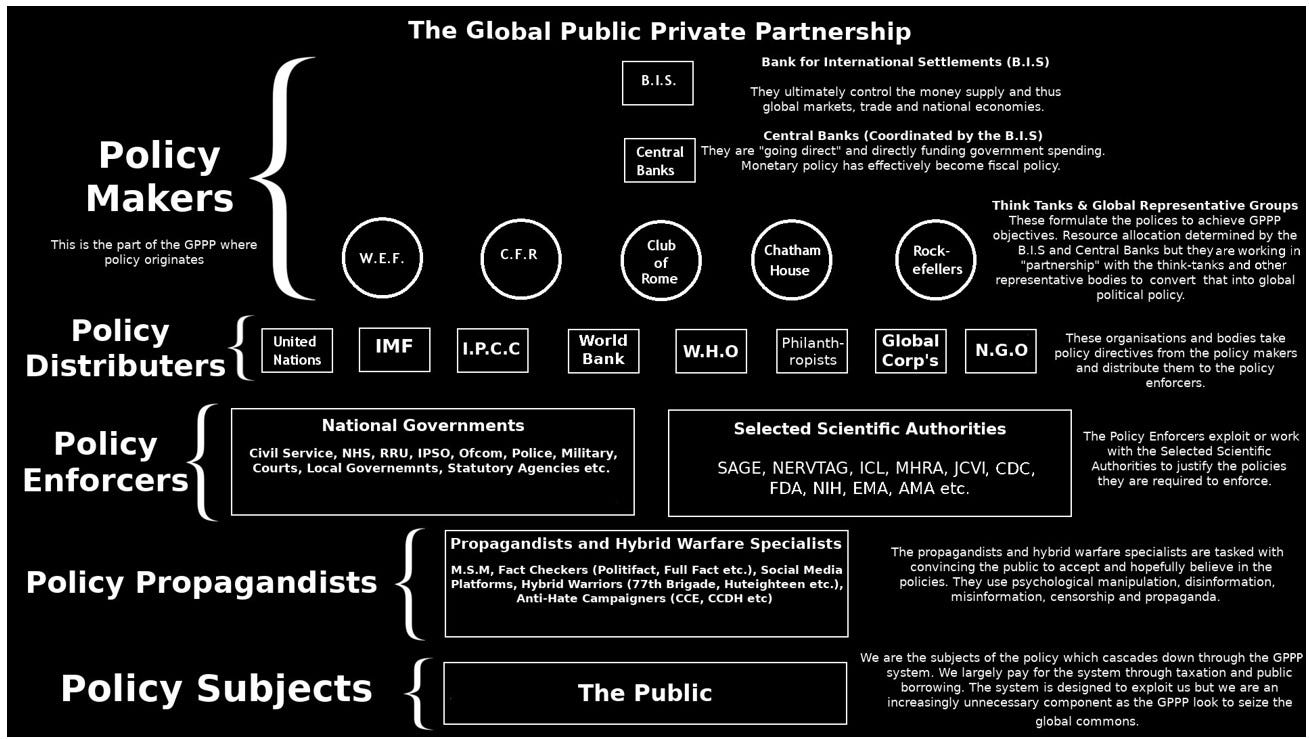

However we come to understand and explain our modern world, our modern Empire, and the middle-management Swarm that runs it, I think this image hovers over enough truth to find a way of incorporating it. I don’t know who the original creator is, but thanks to them and the reader that sent it to me.

You will see that the top of the pyramid is Central Banking.

But it would be all for nothing without The Federal Reserve (The Fed).

That is the ultimate financial weapon. The Death Star.

It is not a publicly owned entity, meaning it is privately owned.

This means that the American public does not control its own Money Power.

Which means that, much more importantly than interest rates (which are important), the Money Supply is not within the nations control. Which means the Velocity of Money is not within the nation’s control.

Private hands control “the flow of money” into the economy, which allows private hands to “create cycles”.

Individuals should not have this power over nation states. But they do.

The Federal Reserve is an illegitimate organ. I say this based on the last chapter of Sutton’s book, below. See what you think after understanding how “they” brought it into being.

There is a free Book Summary of the whole book, “The Federal Reserve Conspiracy” here.

The Manifesto - Lies are Unbekoming (substack.com)

This last chapter is a good insight into The Trilateral Commission (A Rockefeller Body), and its Trilateralists.

It’s also a good insight into Paul Volcker. A supremely important figure that has just come on my radar. I’ll write more on him another time.

Anyway, understanding The Fed, how they brought it into being, and the power they have gained from it, is important in my opinion.

The picture of Empire is incomplete without it.

With thanks to Antony Sutton.

The Federal Reserve Conspiracy by Antony C. Sutton

Chapter 10: The Federal Reserve Today

Today in the 1990s the Federal Reserve quietly, and protected from any public examination or accounting, continues its never challenged monopoly of the money supply.

Its twofold function is: (a) to regulate the flow of credit and money for specific economic objectives, and (b) to supervise commercial banks, i.e., mostly itself.

The central policy-making body of the FRS is the Board of Governors appointed by the President and confirmed by the Senate. Each of the 12 regional banks has its own directors. These are divided into three classes. Class A directors represent the banking system, Class B directors represent industry and Class C, the public, supposedly.

In fact, Class C directors have never represented the public. It is not at all unusual for a banker to serve a term as a Class A director then go on and serve another term as a Class C director.

The Federal Reserve is a private system owned by the banks (see figure below). Fed control over money is a private monopoly granted by Congress.

It's so powerful that no Congressman dare ask simple questions.

Of course, there is good reason why the Fed doesn't want citizens poking around asking questions. It is a moneymaking machine literally — and this is freely admitted by the U. S. Government. Here is an official statement:

Where does the Federal Reserve get the money with which to create bank reserves'?

It doesn't "get" the money, it creates it. When the Federal Reserve writes a check it is creating money. This can result in an increase in bank reserves - a demand deposit or in cash. If the customer prefers cash he can demand Federal Reserve Notes and the Federal Reserve will have the Treasury Department print them. The Federal Reserve is a total moneymaking machine. It can issue money or checks. And it never has a problem in making its checks good because it can obtain $5 and $10 bills necessary to cover its checks simply by asking the Treasury Department to print them. (Source: Money Facts, published by the Committee on Banking and Currency, 1964, U.S. Congress.)

Back in 1913 when the Federal Reserve Act was passed, the idea of a Federal Reserve System - in effect a central bank - was promoted to the American people by both bankers and President Woodrow Wilson as an institution outside the control and influence of bankers - on the grounds that monetary policy was too important to be left in the hands of private interests. However, in fact, the institution is completely dominated, and always has been, by major New York bankers.

The Fed lied!

The very first meeting of the Federal Reserve Bank of New York on October 5, 1914, was held in the offices of the Bank of Manhattan, 40 Wall Street, New York. Bank of Manhattan later merged with Chase National to become Chase Manhattan Bank.

Skipping intervening history for lack of space, we also find that in the mid-1970s, the leading Class A director of the New York Fed was none other than Chairman of the Trilateral Commission - David Rockefeller. David's term expired in 1976 and he was replaced by the chairman of Morgan Guaranty Trust. However, David's influence was perpetuated in two ways: by appointment of Trilateral Paul Volcker as president of the New York Federal Reserve Bank, a permanent position not subject to the necessity of re-election at periodic intervals and appointment of G. William Miller (member of the Chase Advisory Board) as Chairman of the Federal Reserve System, replacing Trilateralist Arthur Burns.

Moreover, others (of the nine) Federal Reserve Bank of New York directors had links to Chase Manhattan Bank. For example, the three Class B directors were Maurice F. Granville, Chairman of the board of Texaco; William S. Sneath, Chairman of the Board of Union Carbide; and John R. Mulhearn, President of New York Telephone.

Let's look briefly at the career of Paul Volcker, former president of the New York Federal Reserve Bank. In 30 years, Volcker has divided his time almost equally between the Federal Reserve Bank, Chase Manhattan Bank and sub-cabinet positions in Washington, D.C. - a perfect example of the so-called "revolving door" and the Trilateral objective of "blurring the distinctions between public and private institutions" for Trilateral advantage.

Paul Volcker was born in 1927 in New Jersey. His first degree is from Princeton, his M.A. from Harvard and his post-graduate work from the London School of Economics - that well known home of British socialism. In 1952, straight from the London School of Economics, Volcker joined the Federal Reserve Bank of New York as an economist. He stayed for five years, until 1957, at which time Volcker moved from Liberty Street to become an economist for Chase Manhattan Bank, where he stayed for four years, until 1961. In 1961, Volcker went to the Treasury Department in Washington, thus completing the first round of his three stop "revolving door." Appointed as Deputy Undersecretary for Monetary Affairs, he held that job just long enough to learn the ropes in Washington, and returned to New York, to Chase Manhattan Bank, as Vice President in charge of Planning. After three years in that post, Volcker left in 1969 to become Undersecretary for Monetary Affairs at the U.S. Treasury Department. After five years, Volcker completed the second round of his "revolving door" with an appointment as President of the Federal Reserve Bank of New York.

Volcker is also a member of the Council on Foreign Relations, the Rockefeller Foundation and the American Friends of the London School of Economics.

If Paul Volcker was a solitary phenomenon, we could make no case for Trilateral control of the Federal Reserve System. In fact, the Volcker phenomenon is one of a dozen parallel situations.

The Revolving Door Career of Trilateral Paul Volcker

1952-57 Economist, Federal Reserve Bank of New York

1957-61 Economist, Chase Manhattan Bank

1962-63 U.S. Treasury

1963-65 Deputy Undersecretary for Monetary Affairs, U.S. Treasury

1965-68 Vice President for Planning, Chase Manhattan Bank

1969-74 Undersecretary for Monetary Affairs, U.S. Treasury

1975President, Federal Reserve Bank of New York

The Federal Reserve Board itself is appointed by the President.

The original Federal Reserve Board represented those very interests that Woodrow Wilson assured the American public would not be represented in the Federal Reserve System. The Chairman of the Board was William G. M'Adoo, a prominent Wall Street figure, former Secretary of the Treasury - and Woodrow Wilson's son-in-law. A key appointment was Paul M. Warburg, the German banker brains behind the Federal Reserve System. The Warburg family controlled the Manhattan Bank. Also on the Board was Charles S. Hamlin, of the Carnegie Endowment for International Peace. Another member of the original board was banker W. P. G. Harding. Franklin D. Roosevelt's uncle, Frederic A. Delano, was Vice Governor of the board - very appropriate because the "liberal" Roosevelts came from an old-time New York banking family. John Skelton Williams, President of the Richmond Trust Company was another member. Thus, the initial makeup of the original Board of Governors reflected the elite and the banking interests and from that time on the Federal Reserve System has continued to reflect those interests.

Trilateral Arthur M. Burns was Chairman of the Board from 1970 to 1978, a dominant voice who pretty much dictated Federal Reserve policy. According to Board member and Trilateral Andrew Brimmer, "Arthur Burns has had a direct hand in selecting every board member."

Trilateral dominance of the domestic monetary system suggests we examine Trilateral world order objectives for a possible linkage.

Trilateral policy makers and analysts fully realize that the world monetary system, with created money as reserve assets, is in a state of collapse. The Triangle Papers dealt with the world monetary systems (Towards a Renovated World Monetary System), and was authored by Richard N. Cooper (later Undersecretary of State for Economic Affairs). Motoo Kaji, Professor of Economics at Tokyo University (author of a book in Japanese, Gendai No Kokusai Kinyu - Contemporary International Monetary Affairs) and Claudio Segre, a French banker with Compagnie Europeenne de Placements.

Triangle Paper No. 1 identified two world problems: (a), how to achieve full employment without "rapid" inflation, and (b), how to combine "managed" national economies into a "mutually beneficial world economy."

It is vital to hold Trilateralist assumptions in mind. Trilateralists are not looking for a solution to the world monetary problems: Trilateralists are looking for a "solution" consistent with, and which will promote, their own objectives. These objectives are: (a), a managed economy, i.e., managed by Trilaterals; and (b), a "new world order" of these managed economies.

Once again we find manipulation of a problem to achieve Trilateral objectives. Almost on a daily basis we find reflections of the struggle to keep a hold on the U.S. monetary system in order to achieve a world federal reserve system.

Fed Monetizes Foreign Debt

In the early 1980s the Fed, through Paul Volcker, conned Congress into another vast expansion of monetary credit through monetization of foreign debt instruments.

The so-called Depository Institutions Deregulation and Monetary Control Act of 1980 is a total misnomer. In practice it brings all banks under Fed control whether they like it or not and gives the Fed power to vastly increase fiat money by monetizing foreign debt, much of it worthless (see attached reproduction from the Bill).

Once again the Fed did everything possible to avoid publicity. Only one Congressman, Dr. Ron Paul, spotted the clause to monetize foreign debt. To avoid any publicity, the

Chairman of the Banking Committee quickly agreed to Paul's request to remove the clause: "You want it removed? We'll take it out."

Then we get a repeat of the unconstitutional conduct surrounding the 1913 FRS Act. The House voted for the Bill without the clause - but in Conference Committee it was quietly re-inserted and became part of the Act as finally approved by both Houses. We doubt any Congressman knew what was included in the bill as finally passed - that's the influence of the Fed today.

Quietly, without fanfare - and with the vast bulk of citizens unaware - the world bankers have been building an international money machine: an international Federal Reserve System with power to control the world's financial and economic system.

The elements of this global money machine can be traced back to the League of Nations and the Bank of International Settlements in the 1920s. After World War Two the International Money Fund and the World Bank were instituted to globalize credit and loans.

Then in the late 1950s came the Eurodollar market, now a vast international market dealing in deposits and credits denominated in dollars outside the United States. The Eurodollar system may in the light of history come to be seen as a first step in a global dollar system. Eurodollars are dealt in by banks not resident in the U.S. and by institutions not subject to U.S. banking regulations and restrictions.

Paul A. Volcker, former Fed Chairman, has made the role of appointments to the Federal Reserve Board clear, - to support the Chairman's policy.

In reference to Clinton appointment Alan Blinder, Volcker commented:

I think a vice chairman has a responsibility for supporting policy in public statements. If he has any real difference of opinion at the end of the day that shouldn't be disguised but as much as possible he should support the institution.

In brief, the policy created by New York bankers should prevail, whatever the personal opinions of the Vice Chairman of the Board or any lesser Director. Which is about as close to a closed shop monopoly as one can get.

In replying to criticism that he spoke out too much, Alan Blinder made a revealing comment: "When we take actions, they are not reversible by any other body of government..." New York Times, September 26, 1994.

So here we have it. The Federal Reserve is a private monopoly of money credit created by Congress under highly questionable circumstances which is beholden to the Chairman of the Board and whose decisions cannot be changed by Government or anyone else.

A free society under the rule of law? The United States has quietly become a hostage to a handful of international bankers. And just dare any Congressman challenge Fed authority!

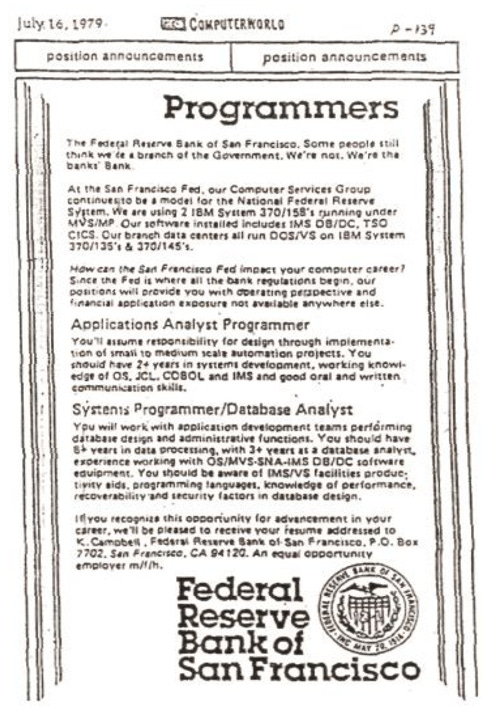

Federal Reserve Bank of San Francisco Claims "Some people think we're a branch of the Government. We're not. We're the banks' Bank."

Thank You for Being Part of Our Community

Your presence here is greatly valued. If you've found the content interesting and useful, please consider supporting it through a paid subscription. While all our resources are freely available, your subscription plays a vital role. It helps in covering some of the operational costs and supports the continuation of this independent research and journalism work. Please make full use of our Free Libraries.

Discover Our Free Libraries:

Unbekoming Interview Library: Dive into a world of thought-provoking interviews across a spectrum of fascinating topics.

Unbekoming Book Summary Library: Explore concise summaries of groundbreaking books, distilled for efficient understanding.

Hear From Our Subscribers: Check out the [Subscriber Testimonials] to see the impact of this Substack on our readers.

Share Your Story or Nominate Someone to Interview:

I'm always in search of compelling narratives and insightful individuals to feature. Whether it's personal experiences with the vaccination or other medical interventions, or if you know someone whose story and expertise could enlighten our community, I'd love to hear from you. If you have a story to share, insights to offer, or wish to suggest an interviewee who can add significant value to our discussions, please don't hesitate to get in touch at unbekoming@outlook.com. Your contributions and suggestions are invaluable in enriching our understanding and conversation.

Resources for the Community:

For those affected by COVID vaccine injury, consider the FLCCC Post-Vaccine Treatment as a resource.

Discover 'Baseline Human Health': Watch and share this insightful 21-minute video to understand and appreciate the foundations of health without vaccination.

Books as Tools: Consider recommending 'Official Stories' by Liam Scheff to someone seeking understanding. Start with a “safe” chapter such as Electricity and Shakespeare and they might find their way to vaccination.

Your support, whether through subscriptions, sharing stories, or spreading knowledge, is what keeps this community thriving. Thank you for being an integral part of this journey.

How Woodrow Wilson escapes being named the worst president of all time is illogical.

A black box to end all black boxes, never properly audited!

https://www.youtube.com/watch?v=WuUPv2XJKm4